How To Update Tax Paid Challan

Tax challan assessment self payment learn quicko advanced rules its How to payment income tax online (challan How to generate challan form user manual

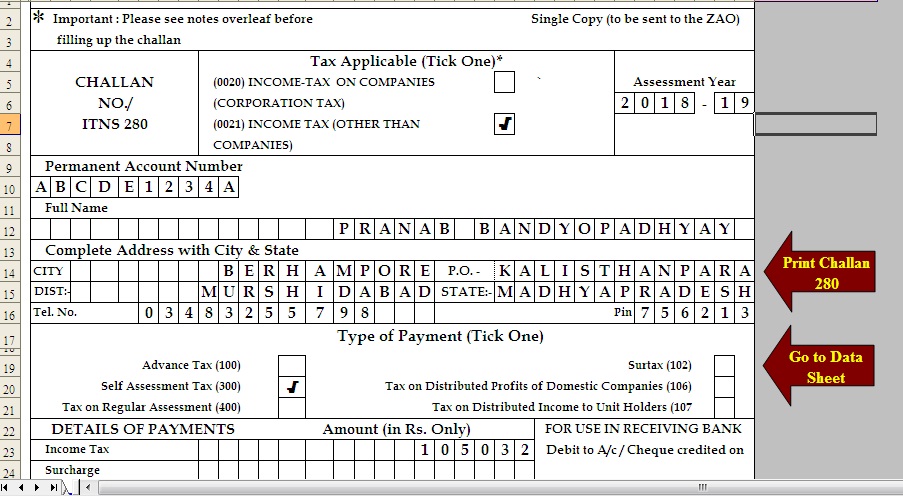

Income tax paid but challan not received | How to download Income tax

Free download tds challan 280 excel format for advance tax/ self What is challan 280: download, types, verifying, income tax challan How to pay income tax challan offline|self assessment tax|income tax

How to download income tax paid challan

Download automated excel based income tax deposit challan 280 fy 2019What does fw mean on a receipt Income tax challanChallan form: fill out & sign online.

Income tax challan procedure onlineIncome tax challan status: how to check tds challan status? Challan 280 : self assessment & advanced tax paymentChallan offline.

Income tax payment challan (guide)

View client details (by eris) > user manualGenerate professional tax challan & payment online in mp Income tax challanProcedure after paying challan in tds.

Income tax challanCreate challan form crn user manual income tax department Tax income challan payment onlineSelf assessment tax, pay tax using challan 280, updating itr – gst guntur.

How to generate challan form user manual

Income taxView challan no. & bsr code from the it portal : help center How to generate challan form user manualChallan tax.

Assessment challan itr updating রত ছবTax payment over the counter user manual Challan taxIncome tax challan fillable form printable forms free online.

How to pay income tax online using challan 280

Post office challan paymentIncome tax paid but challan not received Income tax payment online using challan 280 step by stepOnline income tax payment challans.

Tax challan pay income counterfoil taxpayer online receiptIncome challan tax pay online Tds challan procedure return paying after computation update details these ourHow to fill income tax challan 280 offline.

Income tax challan payment 2023

.

.

Income Tax Challan - How to Pay Your Income Tax Online? - The Tax Heaven

How to Generate Challan Form User Manual | Income Tax Department

Income Tax Challan Payment 2023 - TaxReturnWala

Free Download TDS challan 280 excel format for Advance Tax/ Self

Create Challan Form Crn User Manual Income Tax Department | SexiezPicz

HOW TO PAYMENT INCOME TAX ONLINE (CHALLAN - 280) - YouTube

View Client Details (by ERIs) > User Manual | Income Tax Department